Market commentary

A Rollercoaster Start To The Year!

The first six months of 2022 have not been smooth sailing. The Fed has taken a few shots at record high inflation, and after recent readings, it seems to be heading in the right direction -- downward. However, the question remains, can the Fed can stick the landing of bringing their inflation targets back in line without sending the U.S. economy into recession?

The S&P 500 started off the year by climbing to an impressive high mark of 4,818 on January 4. By late May, after several rounds of indiscriminate selling, it had fallen to a low of 3810. Since hitting its low point, the S&P has quickly put together a group of winning sessions to move up to the 4100 range. This level of volatility within a few months has been difficult for investors to stomach. Many are hoping the worst is behind us.

The biggest drivers of worry have been interest rates and inflation, as Wall Street has battled weeks of negative sentiment, especially within the tech and smaller-cap names. Investors are wondering whether the Fed will be able to engineer a soft landing by raising rates just enough to control inflation without causing a recession. From all the selling in May, it does not appear Wall Street has confidence that the Fed will be successful in this task.

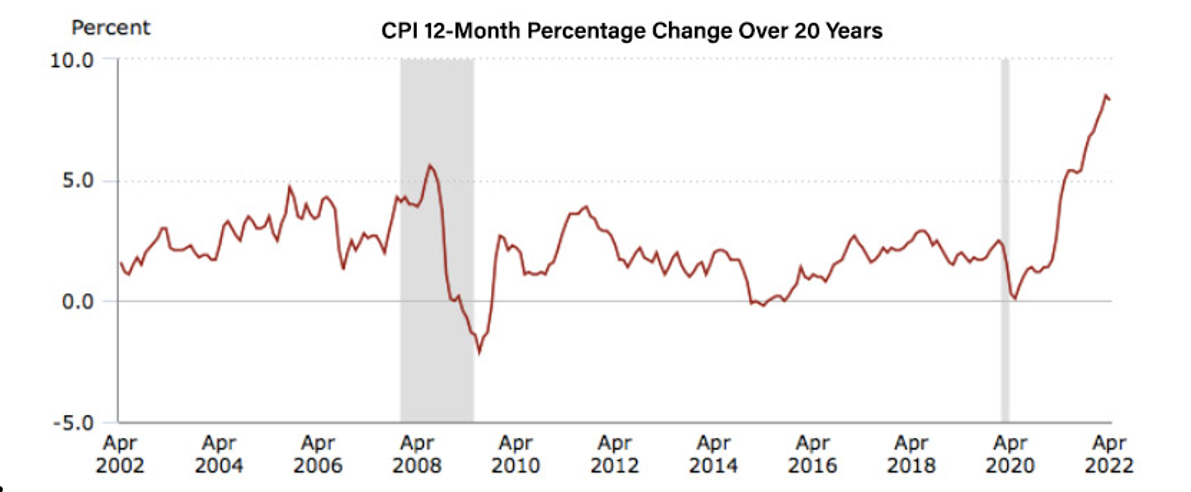

Inflation Up Significantly Over the Past Year

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3% in April on a seasonally adjusted basis after rising 1.2% in March. Over the last 12 months, the CPI basket (all-items) increased 8.3% before seasonal adjustment.

For perspective, for the 12-months ending March 2022, the all items index increased 8.5% before seasonal adjustment. So, the trend is encouraging. But inflation is still more than uncomfortably high, especially inflation on goods.

- Increases in the indexes for shelter, food, airline fares, and new vehicles were the largest contributors to the seasonally adjusted all items increase.

- The food index rose 0.9% over the month as the food at home index rose 1.0%.

- The energy index declined in April after rising in recent months. The index for gasoline fell 6.1% over the month, offsetting increases in the indexes for natural gas and electricity.

Double-Digit Inflation for Lots of Items

On an unadjusted basis and over the past 12 months as of the end of April, there were a lot of items hit with double-digit inflation, including:

- Food at home up 10.8%

- Energy commodities up 44.7%

- Gasoline (all types) up 43.6%

- Fuel oil up 80.5%

- Utility (piped) gas service up 22.7%

- New vehicles up 13.2%

- Used cars and trucks up 22.7%

Existing Home Sales Continue to Decline

Existing home sales fell 2.4% in April to a 5.61 million unit annual rate, its lowest level since June 2020, and below the consensus of a 5.65 million unit rate. It was the fourth decline in the past five months and the third consecutive down month, as the steep rise in mortgage rates to their highest level since 2009 and fast home price appreciation have eroded housing affordability and curbed demand.

It is import ant to note that first-time homebuyers pulled back to 28% of all sales from 30% in the previous month and 31% a year ago. Cash sales, unaffected by the rise in mortgage rates, represented 26% of all transactions, down from 28% in the previous month, but up from 25% a year ago. Median existing home prices rose 14.8% y/y. Excluding the pandemic, this was the fastest price growth since October 2005.

Where Do The Markets Go From Here

History suggests the weak start to the year could continue over the intermediate term, but it does not prevent a second-half rally. Whether or not the market can continue its upward trend before the fourth quarter likely depends on the economy avoiding recession. Particularly concerning is the market reaction to earnings news. Earnings beats have been unrewarded, while earnings misses have been punished severely. It is likely that investors have become overly accustomed to companies beating expectations, while at the same time analysts have been downgrading the earnings outlook for more and more companies.

External risks remain, such as geopolitical tensions with Russia over the Ukraine conflict, as well as with China over territorial claims. While continued volatility is to be expected, we are hopeful that the lows we have experienced recently represent a bottoming of the equity markets.

Investors have benefitted from a disinflationary environment over the past 30 years that has served as a tailwind for both stocks and bonds. As we emerged from the economic turmoil of COVID-19, we have been faced with a new economic paradigm of high inflation, and it has proved challenging to investors with losses in both stocks and bonds. Despite Wall Street concerns, the Federal Reserve has taken decisive action to combat inflation, but restrictive monetary policy brings with it slower growth. While the U.S. economy faces several challenges, we do not expect there to be a recession in 2022.

Even after the U.S. equity markets have snapped their seven week losing streak, uncertainty remains for investors. Our focus and portfolio changes/research continue to be on high quality companies with a long-term track record of sustainable cash flows across market cycles. Also, we are shifting sector allocations to match our expectations for the economy as it trends towards a recessionary environment.

Final Thoughts

As we see down days, we are strategically deploying cash currently on the sidelines. In addition, financial and estate planning opportunities do exist during this difficult market. For example, a IRA to Roth IRA conversion or making lifetime gifts into a irrevocable trust to “lock in” gift/conversion values at lower market prices. We would be happy to meet with you to discuss these strategies in more detail. Please feel free to reach out with questions or to set up a time to meet.

Sources:

Ned Davis Research bls.gov;umich.edu;nfib.com;msci.com;fidelity.com;nasdaq.com;wsj.com; morningstar.com;

Nothing contained herein shall constitute an offer to sell or solicitation of an offer to buy any security. Material in this publication is original or from other sources published with express permission and is believed to be accurate. However, we do not guarantee the accuracy or timeliness of such information and assume no liability for any resulting damages. Readers are cautioned to consult their own tax and investment professionals with regard to their specific situations.